The term capital cost. Now we shall consider three 3 examples on how to calculate capital allowance in Nigeria.

Bill Tracker Excel Template Fresh Download Bill Payment Organizer 1 1 Excel Templates Bill Tracker Bill Payment Organization

Capital Cost Allowance - CCA.

. If you decide to depreciate your capital costs you will also have to pay taxes on capital gains. You also have to add any CCA recapture to your income. How to Calculate Capital Allowances.

Capital allowances consist of an initial allowance IA and annual allowance AA. If your capital property actually gains in value and you receive more back than you paid for it when you sell it later you will pay taxes on that gain. In our previous article we discussed the theory of capital allowance in Nigeria.

How to calculate capital allowance. First deduct the Capital Gains tax-free allowance from your taxable gain. There are a few methods for calculating capital allowances.

Assuming that you have spent an. Different types of assets are allocated to different CCA classes and each class has its own rate for capital cost allowance. The following information will help you complete Part A and Part B of the capital cost allowance schedule on Form T777 Statement of Employment Expenses.

Accounting year ends on 31 December. If this is the first year you are claiming CCA skip column 2 and start with column 3If this is not the first year you are claiming CCA start with column 2Then complete the rest of the columns as they apply. 201a Regulations Parts XI XVII.

You can do this by deducting your tax-free personal allowance 12570 in 2021-22 and 2022-23 from your total income. Capital cost allowance CCA is the depreciation that is allowed to be expensed for tax purposes for fixed assets except land. You group the depreciable property you own into CRA classes of depreciable property.

Annual allowance is a flat rate given annually according to the original cost of the asset. For a list of most classes and their rates go. The capital gain can be further reduced by adding your expenses for property upgrades expenses of transfer and maintenance.

The annual allowance is. This measure will temporarily increase the limit of the annual investment allowance AIA from 200000 to 1000000 for qualifying expenditure on plant and machinery incurred during the period. In January 2018 Company Bee bought plant and machinery for NGN 5000000.

If the property was brought in the year 2000 the gain on the sale will be considered as a long term capital gain. Calculate the capital allowance. Business- Capital Cost Allowance CCA and Rates Capital Cost Allowance Income Tax Act s.

For an explanation of the most common classes of property go to Classes of depreciable propertyA specific rate of CCA generally applies to each class. Youll only pay CGT on the gain you make from an asset rather than the sale price. IA is fixed at the rate of 20 based on the original cost of the asset at the time when the capital was obtained.

This should include any computer hardwaresoftware mobile devices fax machines printers or related equipment and software the company purchased during the tax year in question. A capital cost allowance CCA is a yearly deduction or depreciation that can be claimed for income tax purposes on the cost of certain assets. For assets acquired during the basis periods for the Years of Assessment YAs 2021 and 2022 your company has an additional option to write-off the cost over 2 years.

Calculate your taxable capital gain by deducting the tax-free CGT allowance 12300 in 2021-22 and 2022-2023 from your profits. The Capital cost allowance you can claim depends on the type of property you own and the date you acquired it. The long term capital gain is Rs4980000 Rs7980000- Rs30 lakh.

When filing your Canadian business tax return you will need to list new computer purchases in the proper Capital Cost Allowance CCA classes. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Deferring Capital Gains or CCA Recapture.

Your company may write off the cost of an asset over 1 year 3 years or the prescribed working life of the asset.

Adjusting Entries For Asset Accounts Accountingcoach

New Wage Code 2021 How Does It Impact You Coding Wage Dearness Allowance

How To Find Modified Adjusted Gross Income In 3 Steps In 2022 Adjusted Gross Income Income Investing

Unbilled Receivables Unbilled Revenue Journal Entry P S Of Marketing Accounting Books Accounting And Finance

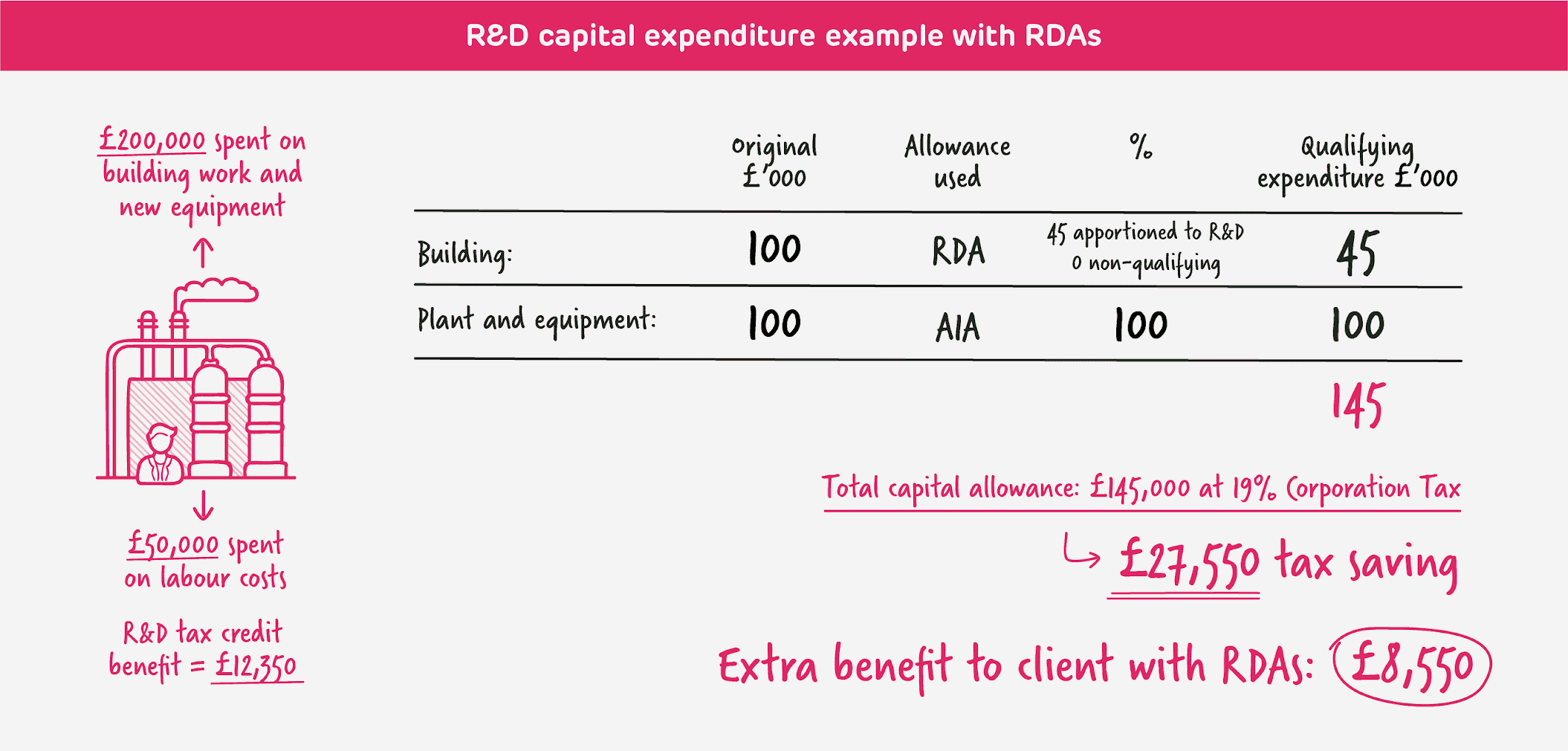

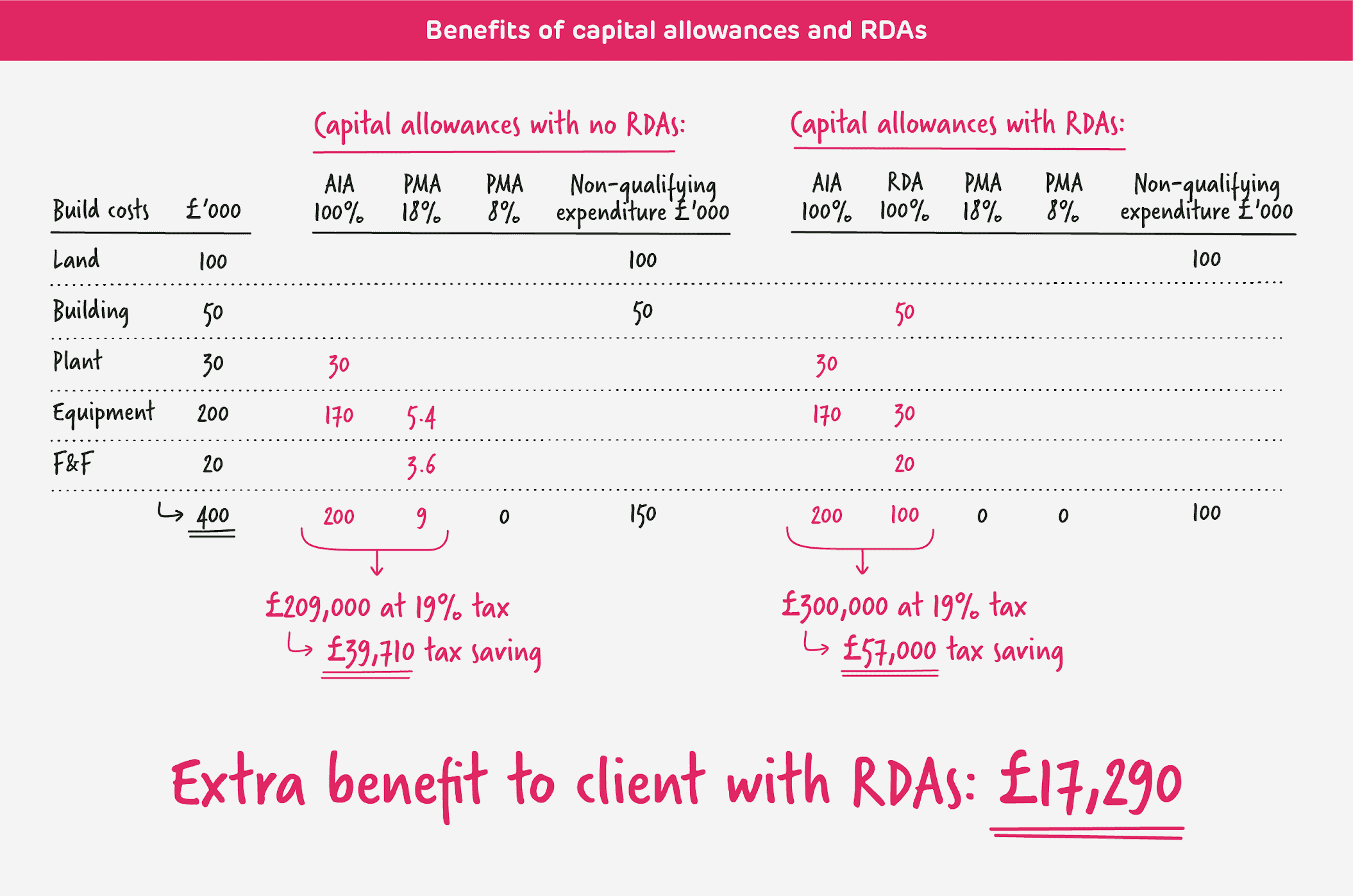

R D Capital Allowances R D Capital Expenditure Explained

How To Calculate Npv With The Effect Of Inflation Tax And Capital Allowance Part 1 Of 2 Youtube

How To Calculate Capital Cost Allowance A Must Know For Your Canadian Business Cold Calling Sales Tactics Cold Calling Tips

How To Calculate Npv With The Effect Of Inflation Tax And Capital Allowance Part 1 Of 2 Youtube

2016 Capital Allowances Sec 11 E General Wear And Tear Youtube

Solved The Following Is The Information Regarding Maya Enterprise Compute The Amount Of Capital Allowance Balancing Allowance Or Balancing Charge Course Hero

R D Capital Allowances R D Capital Expenditure Explained

How To Calculate Ending Inventory Without Cost Of Goods Sold P S Of Marketing Accounting Books Cost Of Goods Sold

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

What Are Dividend Tax And How To Calculate Them A Dividend Tax Is A Sum Of Money That A Limited Company Pays Out To Sh Dividend Accounting Accounting Services

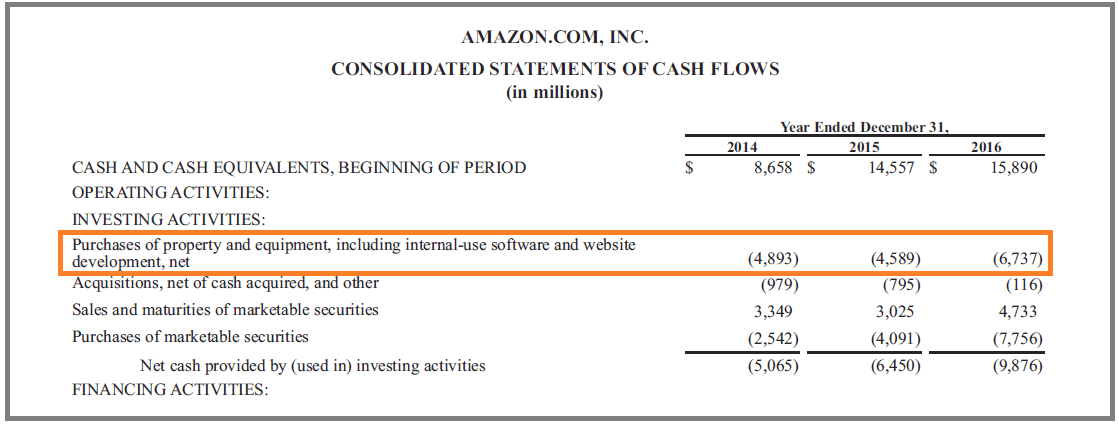

Capital Expenditure Capex Guide Examples Of Capital Investment

Projected Income Statement Template In 2022 Income Statement Statement Template Business Template

Preparing The Capital Allowance Computation Acca Taxation Tx Uk Youtube

Capital Allowances Capital Cost Recovery Across The Oecd

Balancing Adjustments On Pools And Review Of Capital Allowance Computation Acca Taxation Tx Uk Youtube